Hello investors! If you’re new here, add your email below to get every edition of Opening Bell Daily in your inbox, free.

If you saw what happened to stocks to close out last week and how global indexes looked last night, you don’t need me to tell you that fear abounds in markets right now.

The jitters are spreading fast. Markets across Asia and Australia are trending lower, with Japan and Korea’s stock markets plunging late Sunday.

So the elephant in the room: Has the Fed made a mistake by not cutting interest rates already?

Today’s letter is brought to you by iTrust Capital!

You can build your retirement account while leveraging top-performing assets like bitcoin — all without the tax headache.

Bitcoin has been one of the best investments of the last decade, but traditional exchanges mean hefty taxes. iTrust Capital offers tax-advantaged accounts to help you:

Save on taxes

Invest in crypto

Supercharge your retirement

The best investors understand the power of an IRA. Open one today from iTrust Capital.

Fear and trembling in markets

The oldest recipe for disappointment is a mismatch between expectations and reality.

Investors got just that on Friday as the government released a downbeat jobs report just days after Fed Chair Jerome Powell spoke of a still-robust labor market.

The data ran counter to his proclamations and turned the stock market into a fire sale.

Most of the markets’ gains since June 1 were wiped out over the last week.

Investors rushed into safe-haven bets like bonds, sending the 10-year Treasury yield to its lowest mark in nine months. Crypto has also plunged into the red early this morning.

Friday signaled a turning point: Bad news for the economy is (finally) bad news for markets.

Up until last week, equities had a tendency to rally after a softer-than-expected economic print, the idea being that the weaker the data, the sooner the Fed could cut interest rates.

Wall Street may have got too much of what it wished for.

The July jobs report triggered the Sahm Rule, a recession indicator with a perfect track record.

Named after the economist Claudia Sahm, the rule is meant to forecast a recession when the three-month moving average for unemployment rises half a percentage point above its 12-month low.

While Sahm herself said Friday that she doesn’t think we’re in a recession, the rule still begs the question whether the Fed made an error by not cutting rates in July.

Based on conversations I had over the weekend with some very smart investors, I’ve picked up on a growing sense that the Fed is indeed behind the curve.

At the very least, it seems like the Fed missed the opportunity for a more gradual easing cycle.

“With the benefit of hindsight, it’s easy to say the Fed should have cut this week,” JPMorgan economist Michael Feroli wrote in a note.

“Even if the softening in labor market conditions moderates from here going forward, it would seem the Fed is at least 100 basis points offsides, probably more.”

Markets are signaling as much. On Friday, the VIX volatility index — dubbed Wall Street’s fear gauge — spiked as high as 50% before closing roughly 21% higher on the day, almost a two-year high.

Big banks including Goldman Sachs, JPMorgan and Bank of America now expect a more aggressive 50-basis-point cut in September, rather than 25.

Traders, too, see a one in four shot of a 50 basis point cut, according to CME data.

To be fair, central bankers have little choice but to make decisions on backward-looking data.

And until last Wednesday, the data painted a relatively hunky-dory picture.

It’s also true that beyond the labor market, the economy is still showing signs of strength.

As Apollo researchers pointed out Saturday, there is no slowdown in:

Restaurant bookings

Hotel demand

TSA air travel data

Tax withholdings

Broadway show attendance

Those spending trends look solid, but even those may not hold much longer.

Morgan Stanley’s chief investment officer Mike Wilson told clients Sunday that more companies across the above categories are reporting weaker earnings and softer guidance.

“Overall, the macro data suggest we are in a decelerating late-cycle economy,” Wilson said.

“In contrast, the micro data have been less resilient and are showing a more meaningful deterioration in growth, particularly in consumer services, where earnings revisions have recently broken down.”

What’s more likely in the next six months: recession or no recession? Hit reply to this email or let me know on X @philrosenn.

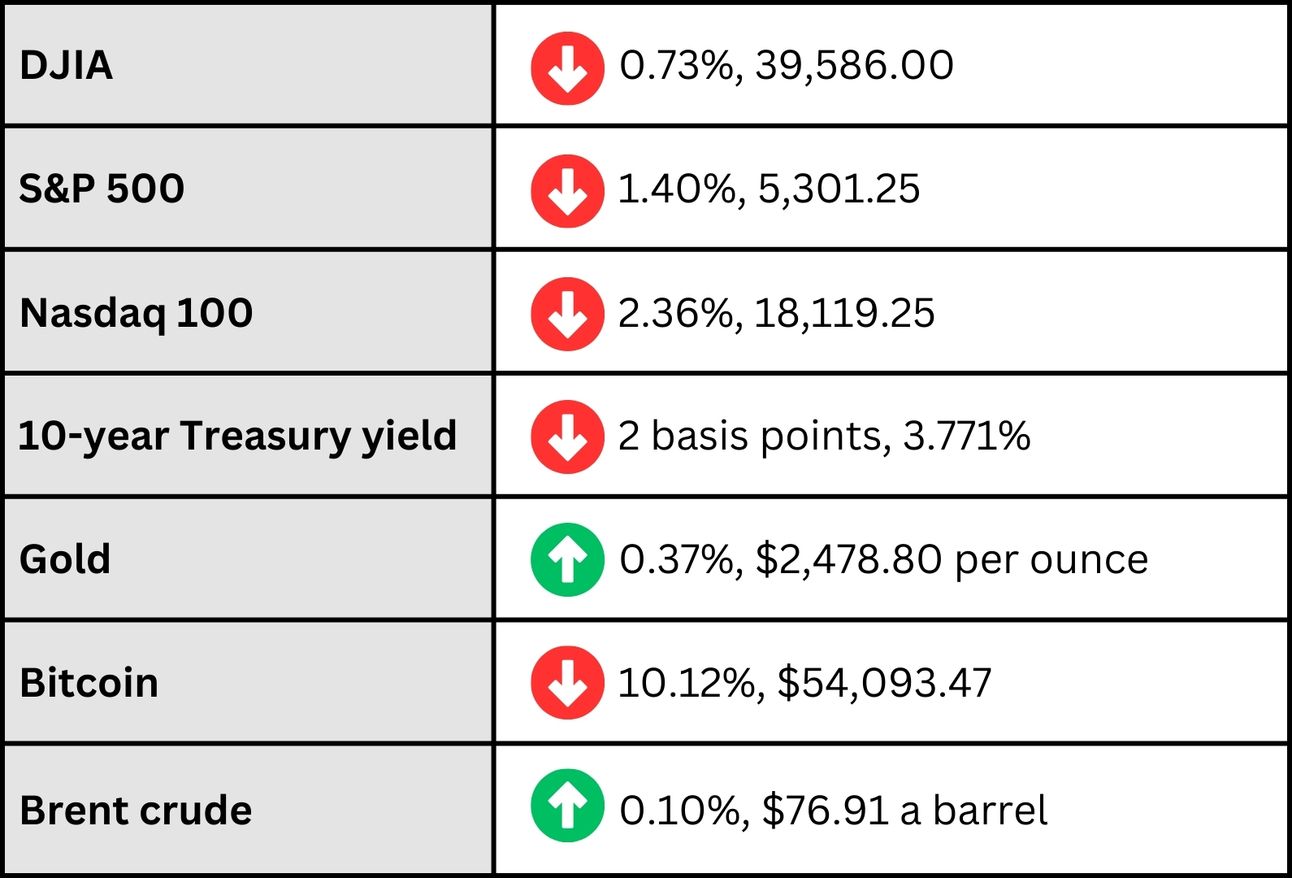

*At a glance:

*Data as of Sunday 10:30 p.m. ET

Elsewhere:

💰 Warren Buffett’s Berkshire Hathaway sits on a record cash pile. The conglomerate cut its stake in Apple by nearly 50% in the second quarter while growing its cash war chest to $277 billion, according to filings released Saturday. That’s up from $189 billion just one quarter prior. (Barron’s)

🗾 Japanese stocks are tanking. The Nikkei 225 and Topix dropped as much as 7% in choppy trading, with major names across the indexes seeing double-digit losses. Both benchmarks are hovering near bear market territory, down almost 20% from their all-time highs reached July 11. (CNBC)

📉 The stock market is in the middle of a rotation. The tech and consumer discretionary sectors took a hit last week, but utilities and real estate performed well. Investors have already taken note — real estate and utility ETFs saw almost $1 billion of inflows over the last five trading sessions. (Bloomberg)

🤝 Government jobs data doesn’t tell the whole story. Opening Bell Daily worked with LinkedIn’s economics team to build an exclusive analysis on the labor market. Days before the official July employment report published, data from the world’s largest jobs network revealed weakening beyond what the Fed had previously acknowledged. (Opening Bell Daily)

Rapid-fire:

The Korean stock exchanged suspended trading briefly as its benchmark KOSPI index tumbled 5% (Forex Live)

Goldman Sachs raised their year-ahead recession odds to 25%, up from 15% (Bloomberg)

Airbnb, SuperMicro Computer, Disney, and Eli Lily report earnings this week (Yahoo Finance)

Bill Ackman bungled his hedge fund’s IPO despite being one of Wall Street’s most prominent investors (WSJ)

Starbucks is coming off an abysmal quarter that saw sales, transactions, and profit margins all weaken (Yahoo Finance)

Mortgage rates are at a 52-week low (HousingWire)

Last thing:

Interested in advertising in Opening Bell Daily? Email [email protected]